Ontario Home Down Payment Assistance Program

The Ontario Home Down Payment Assistance Program is an investor-backed initiative designed to help eligible homebuyers bridge the gap needed for a down payment. Aimed primarily at first-time buyers or those with modest to good incomes, the program provides financial support to make homeownership more accessible. By offering up to $250,000 towards your down payment, it allows individuals and families to secure their dream home while easing the financial burden of saving for a full down payment. This program is an excellent opportunity for those eager to step into the real estate market but needing additional assistance to get started.

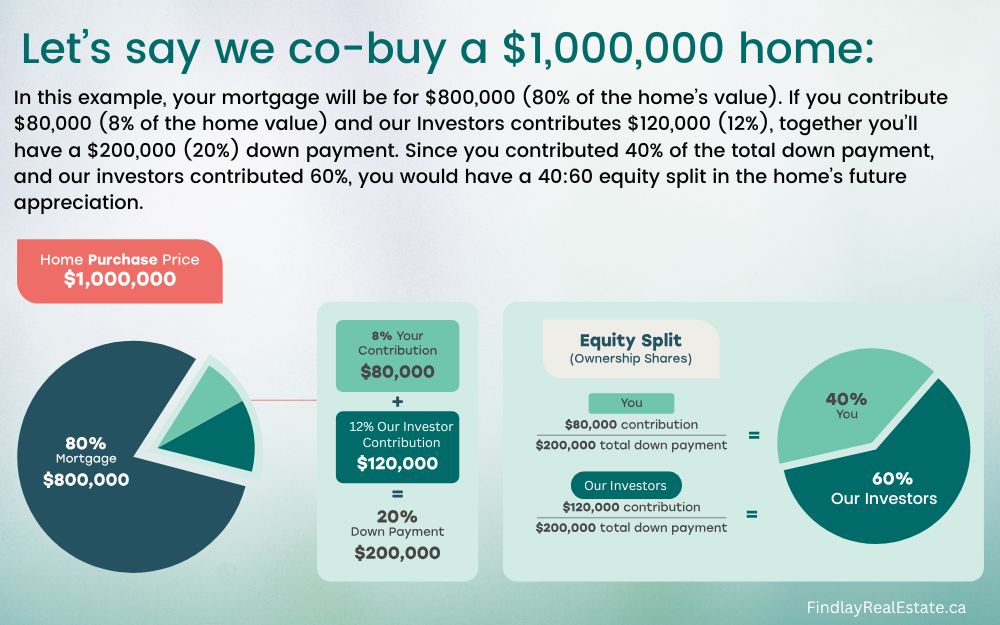

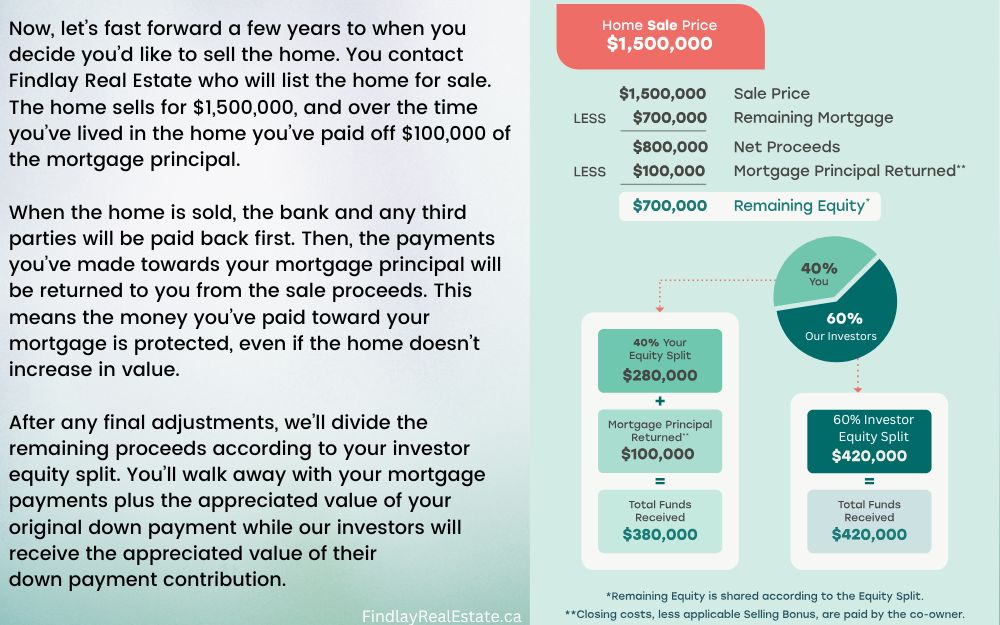

Our investors will contribute up to $250,000 towards your down payment. By contributing to the down payment, they each own an equity share, or percentage, in the home. When it comes time to sell, we divide the proceeds of the sale according to the equity percentage. You and the investors both gain when the home appreciates in value and share the risk if it depreciates.

Since our investors contribution is invested directly in the home, it’s not a loan. There is no interest and no additional debt. You don’t pay them back, the home does when you decide to sell.

Key Features of the Program

- Co-Investment Model:

- Our investors provide a portion of the down payment in exchange for a share in the home’s future value.

- For example, if you contribute 75% of the down payment and our investors provide 25%, they’ll own 25% of the home's appreciation when it’s sold.

- No Monthly Payments to Our Investors:

- Unlike a loan, you don’t make monthly payments to our investors. Instead, they are repaid when you sell the home.

- Home Appreciation or Depreciation:

- If the home appreciates in value, our investors receive their agreed percentage of the increase.

- If the home depreciates, our investors share the loss based on the same percentage.

- Eligibility Requirements:

- The program typically targets first-time homebuyers or those with limited down payment savings.

- Income, credit score, and the price of the property are evaluated to determine eligibility.

- Flexibility in Exiting:

- You can repay our investors by buying back their share at any time, using the home's appraised value at that moment.

Example of How It Works:

This program is beneficial for buyers who are short on their down payment but want to get into the market sooner.

We offer financial assistance to eligible first-time homebuyers in Ontario, helping them get into their dream home sooner. Our program provides up to $250,000 towards your home down payment. This can help make homeownership more accessible and affordable for those who may not otherwise be able to save enough for a downpayment.

To be eligible for our program, you must be a Canadian citizen or permanent resident, and a first-time homebuyer who hasn't owned a home in the past four years. You must also have a minimum down payment of 5% of the value of the home. We work with a network of approved lenders to provide our assistance, so you can choose the lender that's right for you.

Applying for our program is easy. Simply fill out our online application and provide us with the necessary documentation, including proof of income and employment. Our team will review your application and let you know if you're approved. Once approved, you'll receive your downpayment assistance, and you can move forward with purchasing your dream home.

Don't let a lack of funds hold you back from homeownership. Apply for the Ontario Downpayment Assistance Program today and take the first step towards owning your own home.

Our Mission

Findlay Real Estate is pleased to facilitate the Ontario Home Down Payment Assistance program, and a variety of homeownership solutions to complement your lifestyle needs. We understand with today's economy it can be difficult to save up the ideal 5-20% downpayment and other transactional closing fees.

Our mission is to help 100 families & first-time home buyers in Ontario just like you get into their first home by providing up to $250,000 for their downpayment.

To apply for the Ontario Home Down Payment Assistance Program, simply fill out our online application form. Our team will review your application and get back to you as soon as possible. If you're approved, we'll work with you to set up a mortgage pre-approval plan that fits your budget.

Don't let the high costs of a down payment hold you back from your dream of owning a home. Apply for the Ontario Home Down Payment Assistance Program today and take the first step towards becoming a homeowner.

Ontario Down Payment Assistance Program: Your Guide to Homeownership Made Easier

Buying a home in Ontario can feel out of reach for many first-time buyers. With rising property prices, saving for a down payment may seem like a challenge. That’s where the Ontario Down Payment Assistance Program comes into play, providing essential support to help you achieve your dream of owning a home.

What Is Down Payment Assistance?

Down payment assistance programs offer financial support to first-time home buyers who need help saving for the required 5% minimum down payment. Whether through grants, interest-free loans, or shared equity mortgages, these programs aim to make homeownership possible for buyers with limited income or savings.

Types of Down Payment Assistance Available in Ontario

There are several ways to benefit from the Ontario Down Payment Assistance Program:

- RRSP Home Buyers’ Plan (HBP):

Borrow up to $35,000 tax-free from your RRSP, or $70,000 combined with a partner. This interest-free loan must be repaid over 15 years, making it a flexible option for funding your down payment. - First-Time Home Buyer Incentive (HBI):

The government provides 5%–10% of your down payment as a shared equity loan. This means they share in your home’s future value. To qualify, your household income must be under $120,000, and the home price should not exceed four times that amount. - Land Transfer Tax Rebate:

First-time home buyers can receive up to $4,000 as a rebate on the land transfer tax paid when purchasing a property. For example, on a $400,000 home, you could recover a significant portion of your costs. - New Housing Rebate:

If you’re building or substantially renovating a home with a fair market value under $450,000, you may be eligible for a rebate on construction or renovation costs. - CMHC Mortgage Insurance:

This option allows buyers to make a smaller down payment by covering the lender’s risk. It’s an affordable way to lower upfront costs and step into homeownership sooner.

Benefits of Down Payment Assistance

- Eases the financial burden of saving for a large down payment.

- Provides access to government-backed resources designed for affordability.

- Supports first-time buyers in navigating the homeownership journey.

How to Qualify

To access the Ontario Down Payment Assistance Program, you generally need to meet these criteria:

- Be a Canadian citizen or permanent resident.

- Intend to use the home as your primary residence.

- Contribute at least 5% of the home’s value from your own savings.

- Qualify for the necessary mortgage amount.

If you’re not sure which program fits your situation, reach out for a free consultation to discuss your options.

Co-Buy Your Home With an Approved Investor

For buyers needing extra support, our investor partners can co-invest up to $250,000, helping you reach a 20% down payment faster. This option not only eliminates the need for mortgage insurance but also sets you on the path to owning a home sooner.

Get Started Today

Don’t let the down payment stand between you and your dream home. Explore the Ontario Down Payment Assistance Program with our expert guidance.

📞 Call Realtor Sean Findlay

Office: 905-450-8300 | Toll-Free: 1-888-450-8301

📧 Visit Findlay Real Estate to learn more.

Let’s make your homeownership dreams a reality!

Ready To Get Started?

We strive for perfection in everything we do, seeking to outperform the expected. Homeownership made easy!