Canada Housing Market Forecast for 2022

Canada Housing Market Forecast for 2022

2022 has kicked off with most economists and analysts in the U.S. and Canada commenting on record-high inflation levels. As a result, it would seem clearer than ever that both the Federal Reserve and Bank of Canada will begin to raise interest rates sooner rather than later. Experts are predicting that the BOC will see rates spike as early as the end of January.

Here’s what you need to stay in-the-know, whether you are a buyer, seller, or investor…

Surging COVID-19 cases fuelled by the Omicron variant have forced many economists to reconsider their predictions for the Canadian economy in 2022, but it’s not the only shock that could throw a wrench into forecasts.

Canada’s housing market has been flying high for a long time and 2021 saw the market heat up further. Data on Thursday showed prices and sales broke records last year in Toronto and Vancouver, the country’s two most expensive markets. The average price of a house in Toronto, Ontario climbed to $1,095,475, a 17.8 percent jump from the previous record set in 2020.

Capital Economics believes rising mortgage rates will cool home price inflation this year. But there’s a scenario where investors expect prices to keep climbing no matter what, adding fuel to the Canadian Housing Market — and the economy — as home buyers use the equity in an existing property to purchase more. That spells trouble down the line.

While both house price inflation and Canada’s GDP growth would be stronger than we assume in this scenario, we would become extremely concerned about the risk of a house price bust in later years.

It is expected that the Bank of Canada will be hiking the interest rates three times to 1.00 percent by the end of the year.

| In Case You Missed It… In the U.S., consumer prices have hit an almost 40-year high. The consumer price index grew 7% in 2021–the largest 12-month gain since 1982. This significant increase points to “red-hot” inflation that is currently setting the stage for a potential interest rate hike from the Fed as early as March 2022. (Bloomberg) A new study published by The Bank of Canada reported that investors account for almost 20% of all homebuyers in Canada. The report shows that the number of investors in the market first surged in 2017 when prices in large urban centres began to skyrocket, and then again surged at an unprecedented rate in 2021. This is the first study backed by policymakers that comments on the significant role investors play in Canada’s housing market. (BNNBloomberg) Economists at JP Morgan are predicting that The Bank of Canada will raise its benchmark interest rate as early as January 26th. Previously, analysts were forecasting a spike in April. However, based on rhetoric from the central bank along with labour market and economic market data, experts are now saying the bank could raise the rate by 25 basis points to 0.5% at their next meeting on Jan. 26. (BNNBloomberg) |

If you ever have any questions or need any advice, don’t hesitate to contact Realtor Sean Findlay at 905-450-8300

Sean Findlay – Professional Realtor | Sales Representative | Digital Marketing Specialist

– Proudly Specializing in Toronto, Stoney Creek, Hamilton & GTA Real Estate –

Toronto, Mississauga, Brampton, Milton, Oakville, Burlington, Stoney Creek, Grimsby, Hamilton, Niagara Falls.

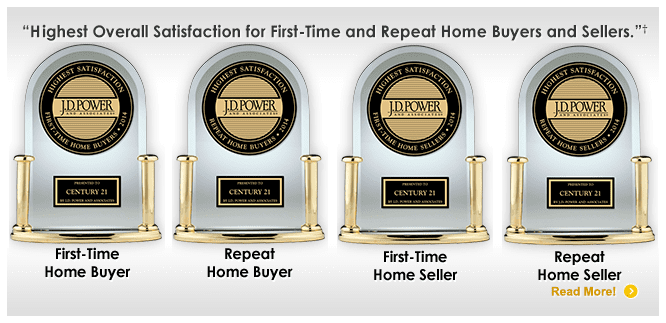

CENTURY 21 Millennium Inc., Brokerage *

Office: 905-450-8300 or Toll Free: 1-888-450-8301 | Fax: 905-450-6736

Toronto Office Located: 181 Queen St E Brampton, ON L6W 2B3 (by Appointment Only)

Stoney Creek Office Located: 280 Barton St, Stoney Creek, ON L8E 2K6 (by Appointment Only)